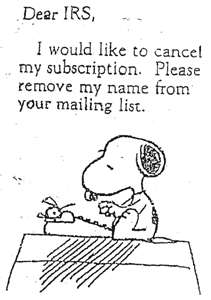

I can literally hear your excitement.

I think the Beatles made an eloquent statement about paying taxes:

According to the Internal Revenue Service, the average income for the tax returns with the 400 highest adjusted gross incomes in 2007, was nearly $345 million. Their average federal income tax rate was 17 percent, down from 26 percent in 1992.

However, over the same period, the average federal income tax rate for all taxpayers also declined to 9.3 percent from 9.9 percent.

The nation’s tax laws are packed with breaks for people at every income level. There are breaks for having children, paying a mortgage, going to college, and even for paying other taxes.

Plus, the top rate on capital gains is only 15 percent.

Per the Tax Policy Center, only 45 percent of U.S. households will pay no federal income tax for 2010.

Both sides of the aisle in Congress want the Tax Code to be changed, because of all the breaks available to the American Taxpayer.

Republicans in the House of Representatives have a plan to eliminate breaks to pay for lower overall rates, reducing the top tax rate from 35 percent to 25 percent. While Republicans are against raising taxes, they argue that a more efficient tax code would increase economic activity, generating additional tax revenue.

President Barack Hussein Obama (mm mmm mmmm, while basically attacking America’s wealthy, said last week he wants to abolish tax breaks to lower the rates and to reduce government borrowing.

Notice that he did not say that he wants to reduce government spending.

According to an analysis by the National Taxpayer Advocate, an independent watchdog within the IRS, our nation’s tax code is filled with a total of $1.1 trillion in credits, deductions and exemptions, an average of about $8,000 per taxpayer.

Speaking of wealthy people, on 5/17/2008. latimes.com reported that:

Speaking of wealthy people, on 5/17/2008. latimes.com reported that:

Obama is the least wealthy of the three major presidential candidates. But with advances and royalties from two bestselling books, Obama’s assets were worth between $2.02 million and $7.35 million at the end of 2007, according to a public financial disclosure report filed with the Federal Election Commission.

On 4/16/2008, washingtontimes.com reported:

Mr. Obama and first lady Michelle Obama reported a taxable income in 2008 of $2,656,902, paying $855,323 in federal taxes and $77,883 in their home state of Illinois.

The Obamas paid a tax rate of 32 percent, which is below the 35 percent top tax rate for incomes above $357,700.

…The president’s two best-selling books, “Dreams From My Father” and “The Audacity of Hope”, brought him $2.6 million, compared with $3.9 million in profits the previous year.

For 2007, the Obamas reported a significantly larger taxable income of $4,139,965.

They also contributed less to charity in 2008 than they did in 2007, giving away $172,050 of their own money compared with $240,370 the previous year.

The two biggest recipients of the Obamas’ giving were the United Negro College Fund and CARE, a nonprofit that targets global poverty.

Mr. Obama did not give any money to his former church, Trinity United Church of Christ, after donating $26,270 in 2007. He and the church’s pastor, the Rev. Jeremiah A. Wright Jr., had a falling-out after incendiary sermons by the pastor surfaced during the presidential campaign.

The Obamas also paid $47,488 in tuition for their two daughters, Malia, 10, and Sasha, 7, to attend the University of Chicago Laboratory Schools.

On 4/15/2010, whitehouse.gov reported:

Today, the President released his 2009 federal income and gift tax returns. He and the First Lady filed their income tax return jointly and reported an adjusted gross income of $ 5,505,409. The vast majority of the family’s 2009 income is the proceeds from the sale of the President’s books. The Obamas paid $1,792,414 in federal income tax. The President and First Lady also reported donating $329,100 to 40 different charities. The largest reported gifts to charity were $50,000 contributions to CARE and the United Negro College Fund. In addition, the President donated his $1.4 million Nobel Prize funds to 10 charities. The President and First Lady also released their Illinois income tax return and reported paying $163,303 in state income taxes.

So, while Americans were scrambling to finish their tax returns ,what was the Leader of the Free World doing? Working on getting 1/6th of our fellow Americans off of Food Stamps? Trying to reduce our pain at the gas pump? Working on getting our Best and Brightest out of harm’s way in 3 different theaters of war?

Errr…no.

It was beautiful yesterday afternoon in Washington, DC. Perfect golfing weather: Sunshine and 64 degrees. So, of course, you know where the President of the United States was: Fore!

It was beautiful yesterday afternoon in Washington, DC. Perfect golfing weather: Sunshine and 64 degrees. So, of course, you know where the President of the United States was: Fore!

He and his buds: Energy Department staffer David Katz, White House trip director Marvin Nicholson, and Marvin’s brother Walter, hit the links.

This was Obama’s 64th golf outing as president.

President Bush played golf 24 times in office. He stopped after the Iraq war began, out of respect for those parents whose young men and women were giving their lives for this country in a foreign land.

President Bush was only fighting one war. Obama has 3 wars in progress.

This was Obama’s third golf outing in the last three weeks, and his sixth time out this year…and it’s just April.

Excuse me, Mr. President. Do you have any Grey Poupon?

dear leader has no respect for others….but shame on those who dare show disrespect to him…

LikeLike

My liberal co-workers at school have been very quiet abt politics for the last year. They never mention BO’s wonderful ‘accomplishments’.

LikeLike

Even my liberal relatives have soured on obaka. I have to restrain myself not to say, “I told you so!!”

LikeLike

I need my Maaylox and Zantac for tax day.

LikeLike

I thought he could no more disown him than his own,, oh, scroo it.

LikeLike

We need to introduce the Golfer in Chief to Carl Spackler…

LikeLike